Make sure you read to the end and check back regularly for fresh information at the end of this page! Evidently, reading is required, specially if you want to achieve something significant. I've tried to be as concise and to the point as possible. At some points you may not understand what I am saying, but do some research or just keep reading, things will become clear at some point...

May 2021

My strategy is my own. I created it from scratch and experience after studying the market for a few years, then hopping on when I actually didn’t have it all worked out yet. I needed to get my feet wet before I could fine tune everything, or just about. It’s been proven time and time again that the best way to learn something is by doing it. I could have created a fake account or practice account which now many brokers offer, such as with Questrade. However, I preferred doing some real footwork. My goal was and is just as anyone else, make as much profit as I possibly can in the shortest amount of time possible. At first, that didn’t work out too well. In the first nine months of investing, I was down 14 percent. I knew most of the basics, but I was only focusing on Market Cap and Free Cash Flow. I decided that I had lost enough and needed to review my strategy...which I will admit was relatively weak. Losing 14% of one’s investments can be a whole lot of money! Amounts are one thing, but what I focus on now and since then is percentages. We all need to increase our funds by the maximum amount of percentage points possible. That being said, I started to focus on Price Targets. I started looking for them and during my searches I found a few very interesting tools. One of the most important ones is a daily newsletter from Marketbeat.

First, create your main live watchlist with a free account on www.marketwatch.com which will allow you to follow live price action at all times, on time, daily, Monday to Friday on the stocks that interest you most. What you might want to do like I do is have one list for the stocks you own (you may need more than one depending how many stocks you'll own, you can create multiple lists) and anything else put on a separate list called something like "prospects".

Then, sign up to get that free daily Newsletter email from https://www.marketbeat.com/invite/RID2833970/ and set up a watchlist which will provide the list of news for all stocks on that list in the same email with the daily lists of Upgrades, Downgrades, New Target Prices and New Coverage by all Analysts for the entire market.

Create or follow my list of potential high profit stocks per average target prices by all analysts price targets, my average price targets are based on six different sites :

https://www.marketbeat.com/invite/RID2833970/

What I did from that point was I created a spreadsheet with Excel (Calc – Libreoffice free or Openoffice free) which I eventually transferred onto Google Sheets for all the Tickers of stocks that interested me once I had done enough research on each one regarding past performance, all the different products and services, the goals of each company, etc. Taking from each site mentioned above the average price targets for each stock (some of the sites may have none) and calculating the average price target from all of them combined I get a global average price target. By sorting the final result from highest to lowest, I was able to decide where to invest to get the best possible profits long term. All price targets are usually based on a 12 month period.

We have been in a bull market for over ten years, since the 2008 crash, partly because there are new retail investors influx every day and that is going to continue because there is more and more awareness and people talking on the street, with their friends, with their families about the availability of self-directed online brokers. This has grown the retail investor basin. I believe we haven't seen the end of that bull market, in fact I believe these past ten years have only been the beginning. I'd be surprised if even 10% of the population have self-directed accounts, although the market is composed of nearly 25% retail investors, not all manage their own accounts, many invest in funds or use financial advisor services. That means there are a lot more people to come. This could go on another 5 to 10 years, who knows maybe even more, causing a continued bull market for years to come, as people become more aware and more knowledgeable in investing. I'd even say that could improve stability in the market as you'll have less and less big funds selling off stocks causing further sell offs and crashes as we’ve seen since February. That along with a new SEC ruling announced October 22nd 2020 and effective as of April 22nd 2021, investors borrowing/margin/short selling will have to have the entire capital funds on hand to be able to use leverage/short sell. https://www.sec.gov/news/public-statement/staff-fully-paid-lending

Imagine how that will help reduce volatility.

I've become more careful with trailing stop orders, as many of the stocks I'm in have had public and direct offerings which make them fall 20-25% causing my orders to sell and then there are stocks I want to stay in even if they drop 30% because I believe in them long term. In fact, I add shares on many of those when they do drop and if I have spare buying power. If I go on vacation, I will put trailing stops at 40-45% as long as I'm up by that much or more. Depending on the intended duration of vacation, I may even consider selling portions of my holdings until I get back.

There will always be weak hands aka Paperhands, Pump and Dumps, Tesla Effects, Euphoria and Stimulus from stimulus (free) money etc. I suspected that not much of the Stimulus money would be put into the Stock Market. However, looking back on that, it would seem as though quite a bit of it has. People who get that money mostly needed it to pay rent, groceries, bills, etc, but apparently many were already well off enough to invest it. The reason this affects the market is mostly because investors believe that this will stimulate sales, thus profits, in the long term...that the economy in general will pick up momentum. Let's just hope that the payback which will come in the form of taxes and inflation won't put the market into a reverse spin down the road, say two years from now. We’ll have to wait and see where this pandemic goes with the vaccination vs the variants, etc. My impression is that we are gaining somewhat of a sense of control.

The entire financials of companies are too vast and are not everything about a company. Some companies have the worse financials but the greatest potentials and vision. People laughed and mocked Elon in the beginning. All those companies need is for the right investor(s) to come along and pour in money, or, that they be bought out and revamped. I still look a lot at the Market Cap vs Free Cash flow, but more importantly products or projects (open and in the works, future), price action and history (channel) and as mentioned average target prices across all Analysts. I also try to see other possibilities. Anything that has more than 20% negative cash flow vs Market Cap I tend to stay away from. I think about examples like RumbleOn, I started investing in that company when it was 0.19c before the reverse split. That's the equivalent of 3.80 after the split...as of writing this the price is 38.86. I was realizing that the EV market was starting to pick up and that with the business setup they have, they were already selling some cars via their platform, but once the EV's start rolling out, people are going to be selling their older or used gas powered vehicles...and low and behold they book a contract with Cargurus which is yet to be implemented from what I can tell and they just recently signed a deal to buy out RideNow. Still, they are up huge. So, Market Cap vs Free Cash Flow is not always significant, but I wouldn’t invest in a company that has huge negative cash. If I’m in one at any given time, it’s likely because that changed with time. A big part of my strategy involves investing before stocks hike according to average price targets. I don’t rely on the highest price targets, but I rely on how much of a percentage of profit can be made from the actual price to the average price target. This is why I am more often than other 99% invested. I invest in long term prospects. When I buy I do so in portions (see further for more details on this), and once I'm up 50-100% I start to take profits in portions to eventually land with only free shares, or just about. The money from the sales goes to investing in my next prospect(s), whether that is a new company position or adding to one I already own. Most of the companies I invest in have great products or projects and mostly for the good of humanity etc. I don't buy many stocks with no price targets. However, I have bought some such as HSTRF (in since 0.075). If you want some good prospects, check these out. Some of the following have broken out already or in the past and may have dropped since the Correction started in Februaray, SAVA, OBSV and NNDM, MARA (Bitcoin mining like SOS), GNOG , OBSV , AMPE, XSPA, BNGO (I was in @ 0.47 with 10k shares), sold some to cover costs and riding free shares long, definitely long, long. Here are some other stocks with high potential, ACST (in @ 0.19), BNGO again of course , NMTR (in @ 0.61) , PSFE , OPEN, COCP , NGA , TDAC , VGAC , BYSI , GNOG , OBSV , IMV , AVXL , NNDM again , DBX , SAVA , LOGC , CATB , CKPT , ETON , ALDX , CNSP , KTRA , IMUX , CLRB , XERS , BLU , OVID , IDEX again , SLRX , ASRT , TXMD , DARE , ATHX , ALNA , NERV , LQDA , MITO , SELB , RMBL (in since 0.19 before reverse split) , MLND , TTOO (in @ 0.60) , HTBX , VXRT , AMPE (in since 0.44) , AIM (in since 0.85)...some will be sooner than the others...and I do have more on my list, but too long to put them all here, for more go to the link for my entire portfolios tickers list at the bottom of this page and on others as well. Those are some with best potentials. I have been in stocks for over two years (in funds for over 20 years). I developed my strategy myself and so far I am up over 250% in two years from my initial investment, but actually only started making profits after recuperating my 14% loss around 18 months ago. I started getting a lot of family into stocks in my second year and have a private group on Facebook (not open to public) and my website for basics which I don't mind sharing. I am in Canada by the way. I own shares in all of those, some have been for longer than others and some have more potential upside than others. Very important, you need to look at the average price targets and you need to look at the price action channel to decide if you are in a buying or in a selling area, buy low sell high. The price action channel is the space between all lows and highs. Read about those and you'll have a good idea of what to buy and when. Visit my Ressources and Multimedia pages for links to sites I use to calculate and make decisions based on the above. The strategy is to buy in portions and sell in portions, most of the time in 3, but sometimes it's worth buying all in one shot or 2 or 4...depends on price vs target and price vs position in channel, news, rumors, etc.

Watch the VIX https://www.tradingview.com/symbols/TVC-VIX/ When this is high it’s potentially a signal that the market is overvalued and could drop, but not necessarily a guarantee that it will.

I think that with the new market (retail investors on the rise) we will see less correction impact. The bull market for the last ten years + has been due to that and should continue with the gradual coming-out awareness of more and more people who are catching on. The stock market is no longer only for the big pockets and there's money to be made there. More awareness, more new investors. If we have 10% of the population investing with self-directed portfolios right now, that's at the most! I'm probably wayyyyyy off on that, it's probably more like 1% or less. That means there's a strong possibility that there are more to come in the next 5 to 10 years and meaning more market stability given there will be less big pockets manipulating it all with big pumps and dumps, etc. I think we are at a crossroads here…

Since the 22nd of April, things have started to settle although we went through a new rough patch. There’s a lot of conglomerated/collaborating big pockets who talk and plan sell-offs which influences Retail investors to sell-off, then they come plowing in once they've attained the desired low and prices just pump back up again. The market always recovers, the only thing to remember is that timing that is next to impossible, other than relying on trends and charts for price action channel to determine where are the best buy and sell points. Otherwise, for anyone investing long term, just dollar cost averaging over time is a good way to make profits unless you have a good enough lump sum for any given reason. Daytrading is not for everyone, definitely not my cup of tea. Most people lose money or don't make much, few have developed a good enough strategy and process. Long term investing has been proven to be more profitable. I believe we will start to see some upside in the entire market as of this coming week or next for multiple reasons. The recent sell offs of EV, small caps, growth stocks and penny stocks were caused by more than just the Semiconductor shortage, the Correction, new virus wave of variants and the SEC issuing a new Staff represented view on short selling/margin/borrowing shares which was announced last October 22nd and they gave a 6 month period for everyone to adjust. I heard President Biden put together a team to work on Short Selling regulation, but that's not mentioned in this statement, link here https://www.sec.gov/news/public-statement/staff-fully-paid-lending

There seems to be some sense of stability. This could potentially affect the entire market by means of less selling and more long term real money making its way back into the market from here on, as well as less short selling. Nio will be a dominating company in the EV market and should be in everyone's portfolio when the price is right, it’s pretty low as I write this. Nio will surely benefit from all this as well and with all the catalysts on the table right now. Many people don’t know or remember that they signed a partnership with Ford, they recently launched their swap station 2.0 with Sinopec and seeing a Shipping B/L for a dozen vehicles going to California in February and new job postings in USA, this tells me they are obviously coming to America at some point... Nio will rise to huge new heights in the months to come. Also, more new/retail investors will start to come into play as well. We are just at the beginning of the Retail investor buzz in my opinion, the Gamestop frenzy and now AMC even WKHS are just the tip of the iceberg. With the new SEC rule, we'll see improvements in volatility, narrower ranges of it as well as less presence. SPACs will also see a rise from here on in my opinion. Let's see what the summer has in store for us :)

Good luck to everyone.

August 25th, 2021

Some of the stocks I have been buying recently which I believe are great buys at their current prices, many of which are down to and below 50% from their 52 week highs and some have had a lot of insider buying and institutional buying lately, such as BNGO which was added to one of the biggest funds in the world by millions of shares, tens of millions of dollars worth. Check them out and check out my profile : SOFI , PSFE , FST , SRGA , SAVA , MRNA , TWLO , AYX , BTAI , STEM , TXMD , MYOV , PLTR , TSLA , BNGO , NNDM , OPEN , GNOG/DKNG , RMBL , CHPT , BLNK , AVPT , WKHS , AVXL , GLMD , ALNA , CRIS , RUN , AGTC , ATOS , AMPE , VXRT , HTBX , AXSM , BEEM , CLBS , COIN , FANG , FUBO , IMV , INO , LOGC , NERV , OEG , OPTT , OTIC , ROKU , SHOP , SLNO , SLRX , VIVE , VYNT , ZEV , ZOM , ADS , AIH , AMZN , ASRT , BHP , CLSK , FRLN , MU , SU , WISH , WATT , ASTS , VUZI

Insider buying on these I know of : FST , TXMD , MYOV , NSPR , SRGA , AVPT , NMTR , GHSI

2021/09/02

I've calculated my gains since Jan 1st, I'm up 20% My initial year goal is 50% from Oct20 to Oct21, so far I am at 42% ; over 30 months 269%

2021/09/03

Michael Burry calls out an incoming market crash every month. Now he's calling it "a 94% crash coming"!! I call him the new Short Extremist! What's his average success rate since he's been a market investor? Oh, right, like 1 in 300, maybe? That's like 0.33% right, only because the market crashed once in his career. The bull market is a trend and certainly not his friend right now. He better get used to it, his success rate will become 1 in 600 if he sees one other major crash in his lifetime, and it's not likely to be 94% down, as millennial investors and self-managed investors are on the rise and not about to stop any time soon. It's also been predicted that the bull market will continue well into the late 2030's early 2040's...look it up. Two months ago, Cathie Wood reiterated statements in those regards quoting Stan Salvigsen from Meryl Lynch's analysis on the Baby Boomers back in the 1990's and this is now shifting to millennials according to Tom Lee of Fund Strat. From what I can tell, the latter is more likely. Not to say there won't be any corrections or crashes along the way, but 94% drop!? Come on, that's borderline insane! Psychological tactics is what he is attempting to use by reiterating that same statement every month. If you say it often enough, people start to believe it even if it's a flat out lie! What happens next is fear sets in and people start selling off, then you get the subsequent panic selling, and voilà you have a correction or a crash. Why be so negative and spread fear like that? Because of his agenda! He has everything to gain from it happening. I say we are going to keep seeing more influx into the market by millennials and self-managed investors which will create more stability as the leverage fund managers once had starts to dissipate and fade to smaller and smaller proportions. Most of the time I'm fully invested, money that sits in a bank account or under a mattress doesn't make any profits and loses value with time. Buying on lows in great companies and selling on highs, always in portions, and constantly watching are part of my strategy.

Here are several reference videos to watch on the subject :

https://www.youtube.com/watch?v=sYSsZTs9LJw

https://www.youtube.com/watch?v=wP9W_g1W1dk

https://www.youtube.com/watch?v=9j93fi1tcjU

https://www.moomoo.com/en/news/post/5120454?level=1&data_ticket=1629458031112028

https://www.youtube.com/watch?v=i17erEpctKQ At 30 minutes

https://www.youtube.com/watch?v=1Z0fgLVQUWo

There's also a lot of money on the side in the market (buying power in accounts directly ready to invest) according to research and outside the market just waiting in bank accounts, under mattresses and there's the trickling in of new retail investors and self-managed accounts day after day. The theory is that this is what has caused the Bull market to be constant for almost 10 years plus and will continue up until and into the late 2030's early 2040's. I can easily see that happening. Bonds never provide as much profitability as the stock market, even the Bond King Bill Gross said so himself yesterday https://www.ft.com/content/f1a48ac2-36fb-4e7f-8d23-71477f1fc0a4. The trick right now is to constantly keep watching your investments, sell portions of stocks that are at all-time highs (pumped) and buy portions of conviction stocks on lows which are up to and beyond 50% lower than all-time and 52 week highs which I mentioned above on August 25th. Value stocks will take a correction this time (the pumped ones), eventually and growth stocks will benefit from the change of wind. Example, if I owned MSFT I would be selling half my position and buying up some AMZN with some of that capital. A correction will occur, a crash could but is not likely right now...although, anything and everything is possible, I'm almost always 99% invested, because when your capital is not invested it's not making any profits. Rebalancing, patience and Due Diligence are essentials for investing. I only invest long term, never touch options, never short sell.

Transcript :

https://cathiesark.com/posts/in-the-know-with-cathie-wood-a-change-of-tone

2022/03/11 NOTE

In September, I advised that I would be selling MSFT when it was above 330$ At the current price, it would be wise to start buying some. AMZN will be splitting 20 for 1 as of next June 6th. That will be good as it will allow more smaller investors to start buying some at around 150$. They will also be buying back 10 Billion $ worth of shares.

2022/03/23

Unless you're a day trader or swing trader, only with ins and outs, you need to be incredibly good at it to make as much as you would with long term investing. You're better off with time in the market (long term) than trying to time the market. Statistics have proven that Long Term Investing outperforms any other form of investing/trading. You can't time the market...or at the very least not with 100% accuracy, your best chances are 50%..., but you can try at your own risk, or, you can simply find the companies you want to invest in by doing your DD (Due Diligence...investigate), watch their price action channels and take advantage of drops to buy in and pops to take profits, buy low, sell high, all while holding a position Long (3 to 5 yrs Mid, 5 to 10 yrs Long, unless fundamentals change) and making sure to follow the price action channel which allows you to time your buy and sell transactions.

That has been my strategy along with watching Analysts average price targets for a little over two years of investing in stocks for the last three years this month after investing for over 22 years in Mutual Funds with which I did relatively well for that sphere of investing. I studied the market when I was in my early 20s but never touched a stock until 2019. I decided to pick up where I had left off over 30 years back and studied stocks for a little over a year in my spare time, all while renovating a house I had owned for around 19 years, buying another house and renovating it during which I sold the first house and moved in with my fiancée, while finishing the current house (still doing renos to this day) and having a full time job (retired now at 53 last year).

My first 9 months in the stock market were from March 2019 where I put in half of my capital, the other half around August and then around November I had lost around 14% of my initial investment. I went out of my way to collect more information on tactics and strategies in general and decided that it was time for me to create my own strategy (first paragraph) and a spreadsheet to follow prices and Analysts average price targets for all the stocks that I found interest in (not available to public), then a separate spreadsheet for stocks that I buy and hold (see link on several pages on this site). So far, my strategy has allowed me to retire last year in February at 53yo with over 450% profits in my two accounts, and even through all this downtrend since the Correction started at the end of February 2021 I continued to apply the same strategy and am still up over 150%, all basically in just around 27 months, which is where I started to watch price targets more avidly Since then, we purchased a new piece of 2 acres of land in an area well desired which will be for our next house which we will auto-construct once we're done renovating the current house.

I consider I've done well enough. I am ultra diversified and yes it all requires being almost full time watching and doing a few transactions almost every week...sometimes just sitting watching for a few days, sometimes a week here and there without any transactions while prices rise. With time, my retirement funds will grow. Time in the market is the best!

2022/04/13

Short Selling :

Short selling is a negative duality to the downside of the market, if there were none, we would have a lot less Corrections and crashes...hence less losses to those who are actually doing right by lending to companies for business opportunity that otherwise would not be possible. It should be illegal. You should either buy or not or only sell and not obtain double for selling and short selling at the same time, because we all know that happens most of the time. Shorting is betting, which makes the market a gambling game, a casino where the odds are on your side by the simple act of doing both, by the same action ridiculing the professionalism and real purpose the market was created for in the first place, to allow businesses to borrow and investors to profit from that said business by getting interest on the loan. Short sellers take both the loaned investment and the profits and by the same process destroy the business and quite possibly the investors along with it! How is that right? How can you be proud of your actions? It's piracy! The SEC and all official regulations entities should ban short selling!

STRATEGY

2023/12/29 :

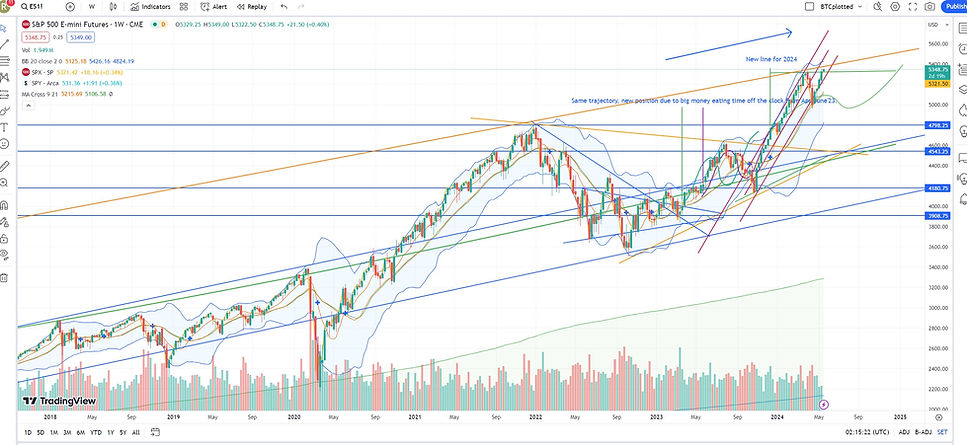

Last March, I had taken some time to do my own market analyses of the S&P500 index and had come up with a plotted trajectory (green line) which I later moved (purple line) due to some lag caused by lagging investing by investment firms. My predictions turned out rather good, almost on point all the way up to today. I have plotted out a new 2024 trajectory according to my predictions (new green line tacked onto the purple one). Let's see how this goes :

20240101 :

My top position is TSLA/TSLL I'm concentrating currently on building positions in TMF and UVIX I am considering URTY Then my top positions right now and which I still need to do some rebalancing are TARK MARA FANG MRNA OPEN SHOP CLSK MSFT SOFI COIN SAVA AYX TWLO SQ BABA AAPL ROKU META RIOT AMZN NIO VALE BTCC.TO and I do own as many others, you can watch my regularly updated portfolios with proportions at the following link :

20240521 :

Up to date chart :

20250207 :

Up to date chart of expected moves for 2025 :

...stay tuned!!!